Login |

About Us

About Us

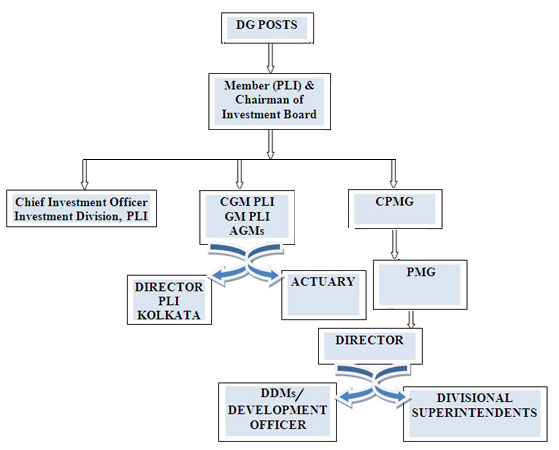

Directorate of PLI under the Department of Posts is the apex body for formulation of all policies, products and administration of the Post Office Insurance Fund. The procurement of business, after sale service and all types of claims management are performed in the field, i.e. Circles. The Office of Director, PLI, Kolkata under the Directorate of PLI functions as the Central accounting Office.

The Investment Division, PLI is headed by the Chief Investment Officer, PLI and is located at Mumbai.

Postal Life Insurance (PLI) was introduced on 1st February, 1884 with the express approval of the Secretary of State (for India) to Her Majesty, the Queen Empress of India. It was essentially a welfare scheme for the benefit of Postal employees in 1884 and later extended to the employees of Telegraph Department in 1888. In 1894, PLI extended insurance cover to female employees of P & T Department at a time when no other insurance company covered female lives. It is the oldest life insurer in this country.

Over the years, PLI has grown substantially from a few hundred policies in 1884 to 42,83,302 policies as on 31.03.2010. It now covers employees of Central and State Governments, Central and State Public Sector Undertakings, Universities, Government aided Educational Institutions, Nationalized Banks, Local bodies etc. PLI also extends insurance cover to the officers and staff of the Defence services and Para-Military forces. Apart from single insurance policies, Postal Life Insurance also manages a Group Insurance scheme for the Extra Departmental Employees (Gramin Dak Sevaks) of the Department of Posts.

With 1,55,669 branches across the country, the Post Office is India's largest retail and financial services provider and is among the most widely recognized and trusted brands in the country, offering a wide range of products and essential services. In India Post, the endeavor is to take advantage of our unique position.

Rural Postal Life Insurance (RPLI) came into being as a sequel to the recommendation of the Official Committee for Reforms in the Insurance Sector (Malhotra Committee). The Committee had observed in 1993 that, only 22% of the insurable population in this country had been insured; life insurance funds accounted for only 10% of the gross household savings. The Committee had observed:

"The Committee understands that Rural Branch Postmasters who enjoy a position of trust in the community have the capacity to canvass life insurance business within their respective areas..."

The Government accepted this recommendation and permitted Postal Life Insurance to extend its coverage to the rural areas to transact life insurance business with effect from 24.3.1995, mainly because of the vast network of Post Offices in the rural areas and low cost of operations. The prime objective of the scheme is to provide insurance cover to the rural public in general and to benefit weaker sections and women workers of rural areas in particular and also to spread insurance awareness among the rural population.

The Department of Posts has started this task entrusted by the Central Government with great dedication and sincerity and within a short span of time, made a very positive impact on the rural populace. Rural Postal Life Insurance, in fact, is meant for anyone who has a rural address. It is a boon for migrant labour and artisans, and the unorganized sector, who move on to urban areas for employment, but continue to have a rural base. Labour migrating overseas are also eligible for a policy. RPLI has now a total of 99,25,103 policies with Sum Assured of Rs. 595,72,59,00,275 as on 31.03.2010

Website Last Updated on:

Website Last Updated on: